Section 501(c)(3) is the portion of the US Internal Revenue Code that allows for federal tax exemption of nonprofit organizations, specifically those that are considered public charities, private foundations or private operating foundations. It is regulated and administered by the US Department of Treasury through the Internal Revenue Service. There are other 501(c) organizations, indicated by categories 501(c)(1) – 501(c)(28). This discussion will focus on 501(c)(3).

Provisions Unique to 501(c)(3)

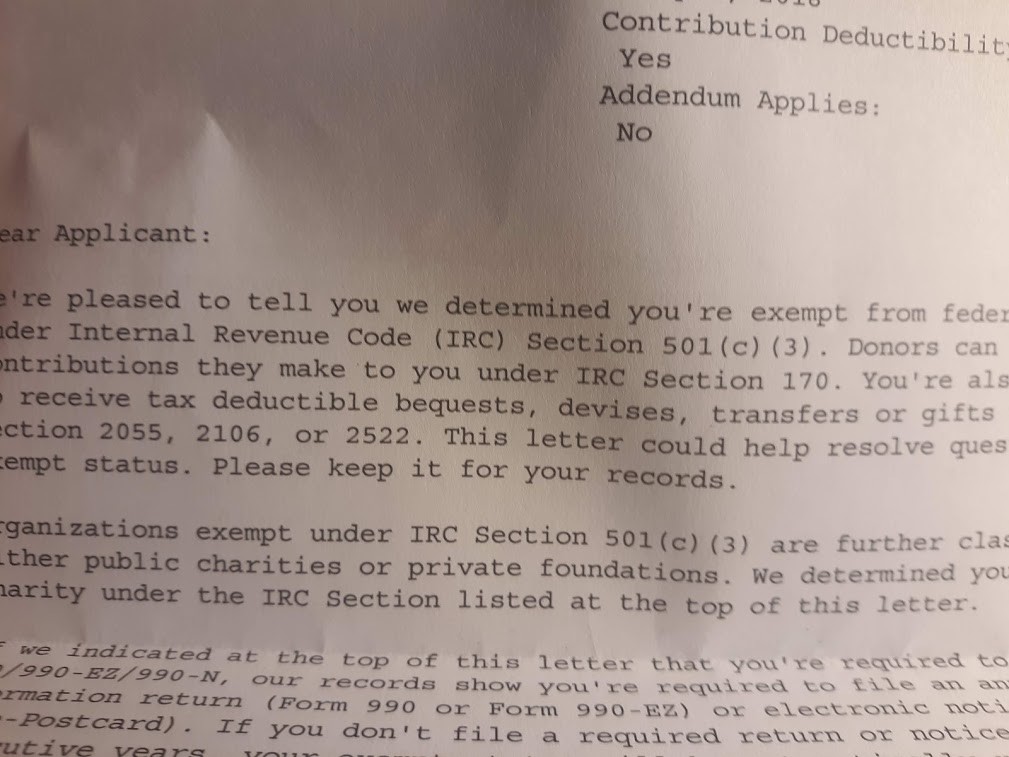

One of the most distinct provisions unique to Section 501(c)(3) organizations as compared with other tax exempt entities is the tax deductibility of donations. 26 U.S.C. § 170, provides a deduction, for federal income tax purposes, for some donors who make charitable contributions to most types of 501(c)(3) organizations[2].

Other unique provisions tend to vary by state. Like federal law, most states allow for deductibility for state income tax purposes. Also, many states allow 501(c)(3) organizations to be exempt from sales tax on purchases, as well as exemption from property taxes. Special nonprofit, bulk rate postage discounts are available from the Post Office to qualifying organizations.

So yes we have Qualified and now we can start really helping the people of this Country.. We have never been happier..